The U.S. cleantech landscape is in a period of unprecedented, policy-driven transformation.

The 2022 Inflation Reduction Act (IRA) catalyzed a manufacturing super-cycle, unleashing $115 billion in investments and plans for 380 new facilities, primarily in the electric vehicle (EV) and battery sectors.

However, this boom is set against a backdrop of acute policy uncertainty.

The passage of the ‘One Big Beautiful Bill Act‘ (OBBBA) in July 2025 has created a perilous “policy cliff,” accelerating the phase-out of key tax credits and introducing stringent new rules that threaten to freeze investment and derail project pipelines

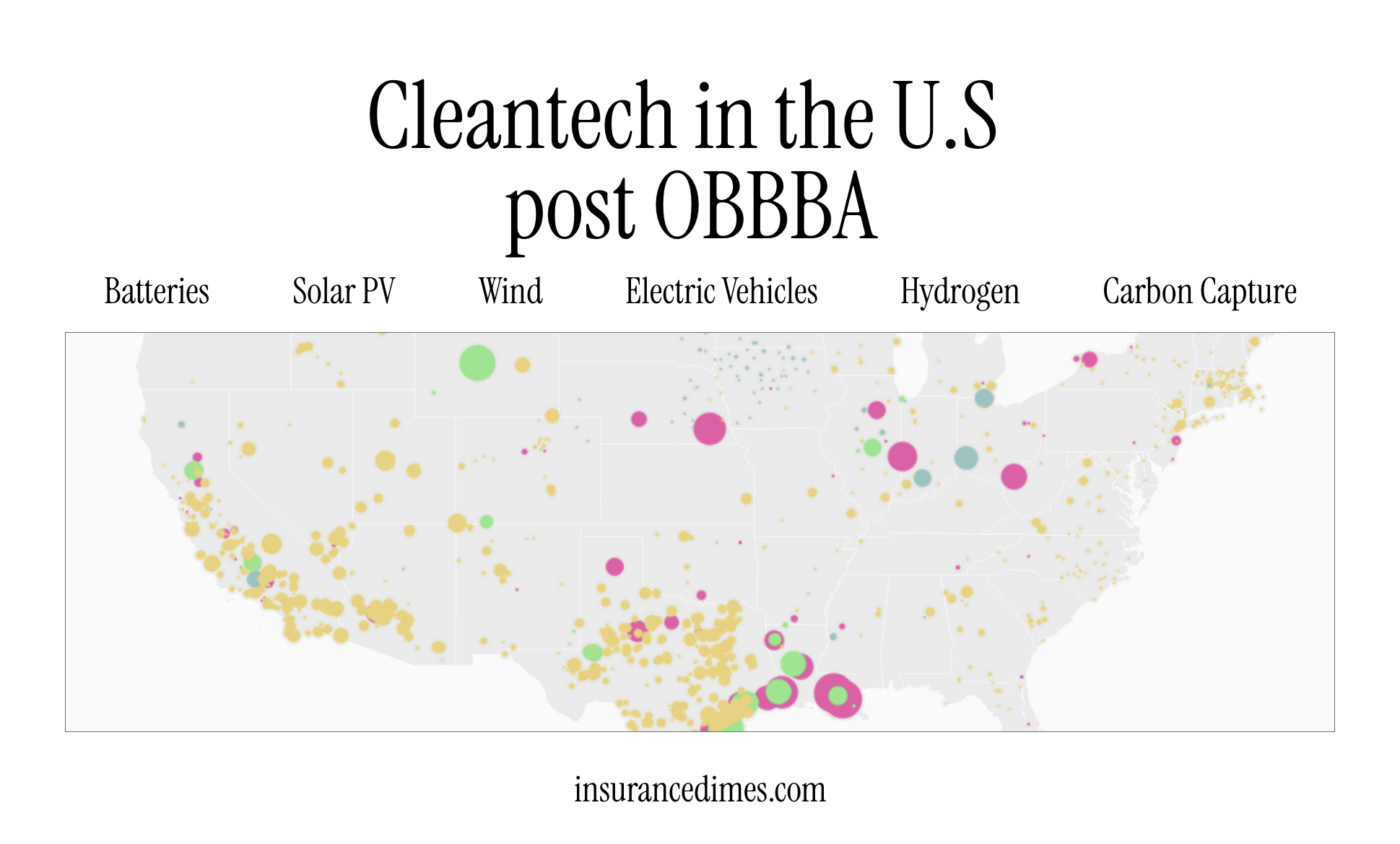

US. Cleantech Explorer

Changes in Cleantech by Sector

Batteries

The U.S. battery ecosystem is scaling at a remarkable pace, but this rapid downstream expansion is creating a severe upstream bottleneck.

While cell and module assembly lines are coming online fast enough to exceed current demand, the domestic supply of critical minerals and processed materials lags far behind.

As of Q1 2025, U.S. battery manufacturing capacity has more than doubled since 2022, with operational capacity already surpassing 2024 domestic demand.

The pipeline of projects under construction points to a massive future expansion.

| Metric | Current Capacity (Q1 2025) | Under Construction (by 2035) |

|---|---|---|

| Operational Projects | 123 | 65 |

| Cell Capacity | 202 GWh/year | +656 GWh/year |

| Module Capacity | 208 GWh/year | +560 GWh/year |

Table source: EIA.gov

This build-out is concentrated in a “Battery Belt” stretching through Michigan, Tennessee, South Carolina, and Georgia, driven by investments from major players like Panasonic, Samsung, and SK.

While cell and module manufacturing booms, the domestic production of upstream battery materials like anodes and cathodes has progressed much more slowly.

This has created a significant dependency on imports, with the value of U.S. battery imports growing from under $15 billion in 2021 to over $33 billion in 2024.

Solar PV

The solar manufacturing sector in the United States is experiencing growth despite uncertainties in policy and competitive pressures.

Texas is emerging as a significant center for this industry, largely due to companies such as T1 Energy, which is collaborating with Corning to establish a solar supply chain based in America, thereby creating thousands of job opportunities.

Although tax credits are set to remain effective until 2030, new legislation introduced under President Trump, along with varying tariffs, is prompting businesses to concentrate on domestic production.

Nevertheless, the U.S. continues to fall short of China in terms of solar technology and capacity.

The imbalance in the domestic solar supply chain is significant. While module capacity is robust, upstream segments are either nascent or non-existent.

| Segment | Operational Capacity (Q2 2025) | Pipeline Outlook | Supply Chain Status |

|---|---|---|---|

| Module | 55.4 GW/year | +42 GW announced; +19 GW under construction | Strength. Sufficient for most 2025 demand. |

| Cell | 2 GW/year | Projected to reach 12.5 GW in 2025; +6 GW planned. | Significant Bottleneck. Extremely limited vs. module needs. |

| Wafer | 0 GW/year | First facilities expected online by end of 2025. | Critical Bottleneck. Complete gap and total import reliance. |

| Polysilicon | ~25 GW/year | +8 GW announced; +9 GW projected by 2035. | Significant Bottleneck. Insufficient for domestic module capacity. |

Table source: seia.org

This domestic manufacturing gap, combined with Chinese oversupply, has created a major price disparity. In Q2 2024, the average U.S.-made solar module carried a 190% price premium over the global spot price.

Wind

Domestic manufacturing capacity for key wind components is insufficient to meet projected long-term demand, with blades being the most critical shortfall.

| Component | Domestic Capacity (Q1 2025) | Projected Share of 2035 Demand Met | Import Reliance Status |

|---|---|---|---|

| Blades | 4 GW/year | 26-36% | High. Majority of blades are imported. |

| Towers | 10 GW/year | 46-65% | Low. Largely self-sufficient. |

| Nacelles | 17 GW/year | Potentially a 27% surplus to 10% deficit | Medium. Assembly is self-sufficient, but internal components are imported. |

The U.S. is capable of manufacturing 7,826 blades, 19,750 towers, and 6,Automakers like Ford, GM, and Hyundai are making multi-billion-dollar investments not just in vehicle assembly but in integrated battery manufacturing facilities, often through joint ventures with established battery makers like SK On and Panasonic400 nacelles annually as of late 2023, but this is not enough to close the gap, especially for blades

The heavy reliance on foreign components, particularly from China, has raised alarms. In 2023, 76% of the total value of imported wind blades and hubs came from China.

Electric Vehicles

Major automakers have announced ambitious plans to scale EV production capacity in North America through 2030.

| OEM | Projected Annual Production Capacity (2023-2030) | Key Investment / Facility |

|---|---|---|

| Tesla | 1,850,000 | $10B for 500k units in Austin, TX; 750k units from rumored Mexico plant. |

| Ford Motor | 1,300,000 | Blue Oval City, TN to add 500k units by 2025. |

| General Motors | 1,040,000 | Flexible production strategy to meet demand; 79 operational projects. |

| Stellantis | 460,000 | Retooling of Brampton, Canada plant for 285k units by 2025. |

| Toyota Motor | 420,000 | Significant investment in North American ZEV capacity. |

| Hyundai Motor Group | 350,000 | $5.5B facility in Bryan County, GA for 300k units by 2025. |

| Volkswagen Group | 260,000 | Capacity to increase from 60k (2023-26) to 260k (2027-30). |

| BMW Group | 260,000 | Capacity to increase from 80k (2025-26) to 260k by 2027. |

| Renault-Nissan-Mitsubishi | 230,000 | Retooling of Canton, MS plant for 200k ZEVs by 2025. |

| Geely Group (Volvo, Polestar) | 150,000 | Planned North American production capacity. |

| Mercedes-Benz Group | 90,000 | ZEV production plans for North American market. |

| Honda Motor | 60,000 | Initial phase of ZEV production capacity in the region. |

Table source: The Belfer Center

As of Q1 2025, 79 operational EV manufacturing projects had a combined capacity of 2.58 million EVs, already exceeding 2024 sales, indicating the scale of the build-out.

Automakers like Ford, GM, and Hyundai are making multi-billion-dollar investments not just in vehicle assembly but in integrated battery manufacturing facilities, often through joint ventures with established battery makers like SK On and Panasonic

Hydrogen & Carbon Capture

The U.S. has established generous tax credits for clean hydrogen and carbon management, but the viability of these sectors is entirely dependent on the build-out of massive, unfunded infrastructure for CO2 transport and storage.

| Technology | Key Incentive | Outlook & Targets | Key Challenge |

|---|---|---|---|

| Clean Hydrogen | Section 45V Credit | 16 MMT/yr capacity by 2030; demand to grow 40% by 2035. | Stringent hourly matching rules; need for hubs and pipelines; 2 of 7 federal hubs canceled. |

| Carbon Capture (CCUS) | Section 45Q Credit | 50-70 MMT/yr capture by 2030; BNEF forecasts 200 MMT/yr. | Requires 10k-15k miles of new CO2 pipelines and 120-140 Class VI wells by 2030. |

| Direct Air Capture (DAC) | Section 45Q ($180/ton) | DOE targets 25-30 MMT/yr by 2030 (from <0.01 MMT/yr). | High costs; need for long-term offtake; dependent on CCUS infrastructure. |

| BECCS | Section 45Q Credit | Leading CDR form (87% of 2024 offtake). | Reliant on CO2 infrastructure and sustainable biomass feedstock. |

The DOE’s vision for a network of Regional Clean Hydrogen Hubs has hit early obstacles.

While the U.S. National Hydrogen Strategy envisions these hubs as critical infrastructure, the DOE has already confirmed the cancellation of funding for two of the seven federally-backed projects.

The success of CCUS, DAC, and “blue” hydrogen hinges on the development of a vast network for CO2 transportation and permanent storage.

The DOE’s Carbon Management Liftoff Report states the need for interconnected industrial systems, but achieving the required 10,000-15,000 miles of new CO2 pipelines and 120-140 permitted Class VI storage wells by 2030 is a monumental task facing significant permitting, financing, and public acceptance hurdles.

Data Tables & Methodology

This report is based on an aggregation and synthesis of publicly available data, industry reports, and policy analyses from sources including the Clean Investment Monitor, the U.S. Department of Energy, the International Energy Agency, and various market research firms and legal advisories.

All data is current as of the third quarter of 2025 unless otherwise noted.

Projections and forecasts are based on the scenarios and assumptions outlined by the original source materials.

All monetary figures are in U.S. dollars. The analysis aims to provide a strategic overview and is not intended as financial or legal advice.

Leave a Reply