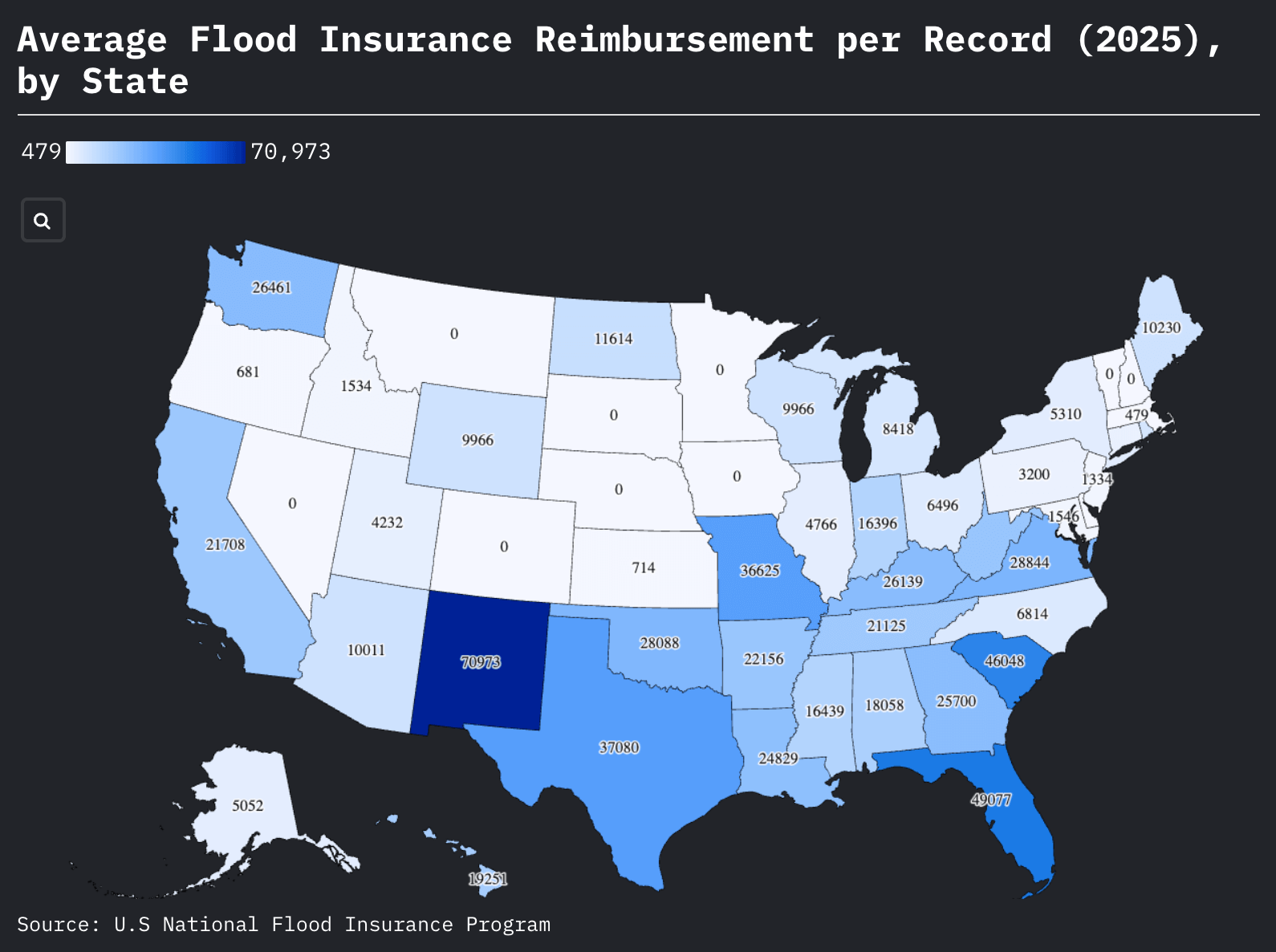

Looking at the 2025 flood insurance data published by the National Flood Insurance Program, several compelling patterns emerge that reveal both expected and surprising trends in flood risk across America.

hover over the map to reveal labels and more information.

Flash Flooding in New Mexico

New Mexico’s position as the nation’s most expensive per-claim state ($70,973 average) takes on devastating clarity when viewed against recent events.

The state’s 99 total records might seem modest, but the recent Ruidoso tragedy reveals why each claim carries such extraordinary costs.

On July 8, 2025, historic flash flooding swept through Ruidoso, with three people tragically losing their lives as a result of unprecedented floodwaters

The victims were swept away by what authorities described as “record-breaking” floodwater in the wildfire-scarred village.

The Ruidoso River rose by 20 feet in less than an hour, shattering records, with videos showing homes floating down the river

At least 200 homes were damaged in this single event, marking the second year in a row that flooding hit the area.

The flash flooding occurred when heavy monsoonal rains fell on burn scar areas from last year’s South Fork and Salt fires, creating dangerous conditions that led to rapid water rise.

This combination—intense rainfall on fire-damaged, water-repellent soil—creates flash floods so sudden and powerful they don’t just damage homes, they completely destroy them or carry them away entirely.

Florida’s Outsized Impact

Florida’s dominance in the dataset—over 21,000 records representing 74% of all flood insurance claims—reflects a state under siege from multiple water threats throughout 2025.

The numbers tell a story of both crisis and resilience: a 71% closure rate with payments and $49,077 average payouts demonstrate a flood insurance system battle-tested by constant use.

The 2025 data captures the aftermath of a devastating sequence of events.

Early May brought an atmospheric river that slammed Florida with torrential rain, with Miami roads flooding after tropical moisture shattered daily rain records

This was followed by a 1,000-mile storm stretching along the Eastern Seaboard that brought some of the heaviest rain since Hurricane Helene

Many Floridians were still recovering from previous disasters—residents displaced by Helene were flood-proofing homes ahead of hurricane season, with some having torn down their homes after Helene’s storm surge ravaged their houses, destroying most everything they owned

Inland Hurricanes in Texas

Texas’s 1,805 records and $37,080 average payout reveal a state grappling with multiple flood threats.

Texas is dealing with what you might call “inland hurricanes”—massive storm systems that bring hurricane-level flooding far from any coastline.

The data captures the impact of severe weather events that have increasingly targeted the state’s inland areas.

The state’s relatively high average reimbursement payout suggests these aren’t minor basement floods but substantial property damage events, possibly from the severe thunderstorm complexes that have become more intense and frequent.

Kentucky’s numbers are fascinating too—2,082 records with a $26,139 average payout.

That’s more claims than Texas despite being a much smaller state.

Appalachian Flooding in Missouri

The Appalachian terrain creates these perfect flood traps where steep valleys can become death sentences when heavy rains hit.

What’s surprising is seeing Missouri with only 273 records but an average payout of $36,625—that’s approaching New Mexico levels of per-claim expense.

Contrasts in the Carolinas

The contrasts are striking. Look at South Carolina with just 74 records but a massive $46,048 average payout—second highest in the nation.

That screams “major storm event” or “total loss scenarios.”

Meanwhile, North Carolina has 118 records but only $6,814 average payouts.

These neighbouring states are clearly dealing with completely different types of flood events.

West Virginia

Some of the data tells stories of ongoing struggles. West Virginia’s 358 records with $22,514 average payouts reflects a state where mountain flooding is becoming a regular nightmare.

The steep terrain means even moderate rainfall can quickly become catastrophic.

Other Interesting Data Points

Then there are the puzzling zeros.

Colorado, Delaware, Iowa—states with open cases but zero payouts.

Either these are very recent events still being processed, or there’s something more complex happening with how claims are being handled in different states.

What’s becoming clear is that flood insurance isn’t just a coastal problem anymore.

Indiana has 319 records, Wisconsin has claims, even traditionally dry states are showing up with significant activity.

Climate change seems to be democratizing flood risk, making it less about where you live relative to the ocean and more about whether your local infrastructure can handle increasingly extreme weather events.

Leave a Reply